Q2 earnings outperformance puts MSGE in focus

Madison Square Garden Entertainment (MSGE) has moved onto more investor watchlists after its latest quarterly results, where revenue, net income and earnings per share all came in above analyst expectations.

See our latest analysis for Madison Square Garden Entertainment.

The stronger than expected Q2 numbers sit alongside a solid recent run in the shares, with a 30 day share price return of 10.62% and a 90 day share price return of 23.50%. Over the past year, total shareholder return of 65.67% suggests momentum has been building around Madison Square Garden Entertainment as investors react to the latest earnings updates and upcoming events such as the recent Q2 earnings call.

If this kind of earnings driven move has your attention, it could be a good time to broaden your watchlist and check out 22 top founder-led companies as potential next ideas.

With MSGE trading at US$60.85 and sitting at a discount to both analyst targets and some intrinsic value estimates, you have to ask: is there still underestimated upside here, or is the market already pricing in future growth?

Most Popular Narrative: 2.5% Undervalued

With Madison Square Garden Entertainment last closing at $60.85 against a narrative fair value of $62.43, the spread is tight enough that the underlying assumptions matter more than the headline gap.

Ongoing investments in premium hospitality and suite renovations, coupled with rising urban affluence and focus on upgrading the guest experience, are expected to further boost ancillary and high-margin revenue streams, improving overall profitability.

Curious what earnings path and margin profile sit behind that fair value and future P/E assumption? The narrative leans on steady growth, richer mix, and shrinking share count. The full story ties these threads together in one clear set of expectations.

Result: Fair Value of $62.43 (UNDERVALUED)

Have a read of the narrative in full and understand what’s behind the forecasts.

However, this hinges on MSGE keeping key venues filled and premium pricing intact. Any slowdown in discretionary spending or weaker marquee events could quickly challenge that view.

Find out about the key risks to this Madison Square Garden Entertainment narrative.

Another angle on MSGE’s valuation

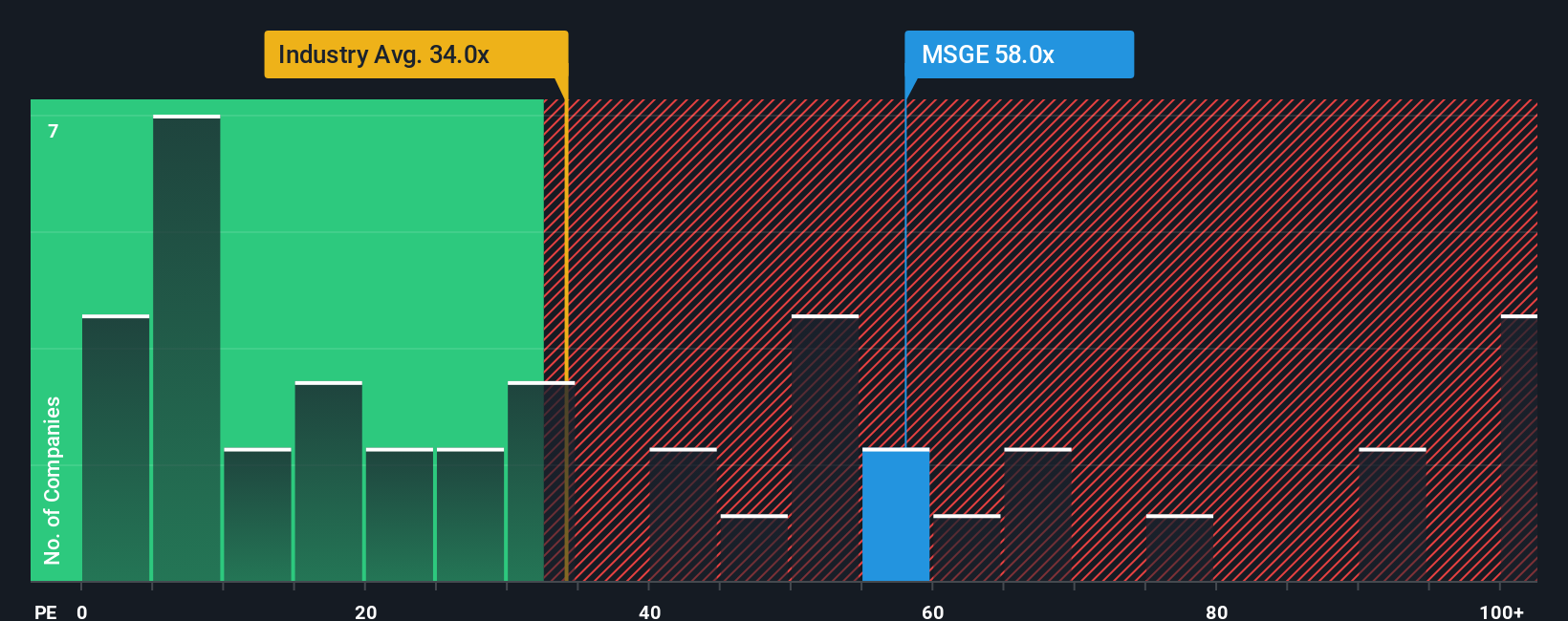

The fair value narrative points to a modest 2.5% undervaluation, but the current P/E of 55.4x tells a tougher story. That is higher than both the US Entertainment industry at 26.4x and peers at 49x, and also well above MSGE’s fair ratio of 26.8x. This suggests meaningful valuation risk if sentiment cools. Which lens do you trust more when expectations are this elevated?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Madison Square Garden Entertainment Narrative

If you are not fully on board with this view, or you prefer to stress test the numbers your own way, you can build a fresh Madison Square Garden Entertainment narrative in just a few minutes. To start, use Do it your way.

A great starting point for your Madison Square Garden Entertainment research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If MSGE is on your radar, do not stop there. The same effort can open up a wider set of opportunities that might suit your style even better.

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We’ve created the ultimate portfolio companion for stock investors, and it’s free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email [email protected]