Live Nation Entertainment (LYV) is back in focus after reports that the company is in talks with the U.S. Department of Justice to settle monopoly accusations without going to trial, a development closely watched by investors.

See our latest analysis for Live Nation Entertainment.

The stock has been active, with a 2.49% 1 day share price return and a 12.00% 7 day share price return, while the 1 year total shareholder return sits at 1.50% and the 3 year total shareholder return is 98.02%. This suggests momentum has recently picked up around the $154.87 level as investors react to progress on the DOJ talks and earlier price moves around February trading sessions.

If this regulatory news has you thinking about what else could be moving next, it might be a good time to broaden your search with our 23 top founder-led companies.

With Live Nation posting positive revenue and net income growth, a price near $154.87, and trading at a small premium to one intrinsic estimate, investors now have to ask: is there real upside left here, or is the market already pricing in future growth?

Most Popular Narrative: 8.7% Undervalued

At a last close of $154.87 against a most-followed fair value estimate near $170, the current price sits below the narrative’s implied worth, which is built on specific revenue, margin, and earnings assumptions.

Continued focus on vertical integration, especially in global venue development and operation, allows Live Nation to capture a greater share of the event value chain, facilitates operational efficiency, and enhances ancillary revenues (e.g., sponsorships, food and beverage, VIP packages), directly benefiting net margins and overall earnings.

Want to see what is baked into that fair value near $170? The narrative leans on rising earnings, improving margins, and a rich future profit multiple. Curious which specific growth and profitability assumptions are doing the heavy lifting in that model, and how they stack up against industry norms and long term expectations? The full story is in the detailed narrative.

Result: Fair Value of $169.71 (UNDERVALUED)

Have a read of the narrative in full and understand what’s behind the forecasts.

However, there is still meaningful execution risk around regulatory outcomes, as well as ongoing tension with artists, venues, and emerging ticketing platforms that could challenge the bullish case.

Find out about the key risks to this Live Nation Entertainment narrative.

Another Angle On Valuation

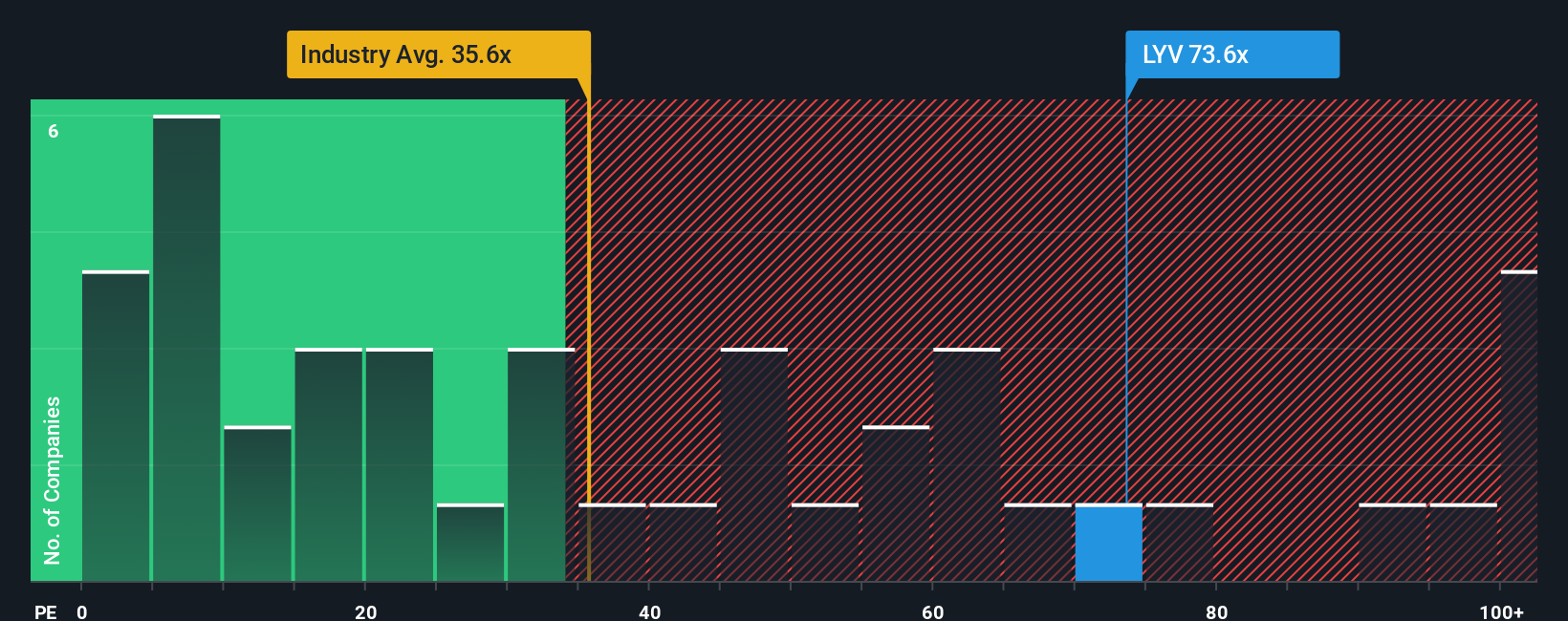

The narrative points to roughly 9% upside to a fair value near $170, but the P/E presents a tougher picture. At about 111.6x earnings vs 30x for the US Entertainment industry and 80.5x for peers, and a fair ratio of 41.6x, the current pricing places significant weight on future growth actually materializing. How comfortable are you with that kind of valuation gap?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Live Nation Entertainment Narrative

If this take does not quite match your view or you would rather rely on your own work, you can spin up a custom thesis, challenge every assumption, and build a version that fits your expectations in just a few minutes, then Do it your way

A great starting point for your Live Nation Entertainment research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

If you are serious about putting fresh capital to work, do not stop at one company when the Simply Wall St screener can surface so many other angles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email [email protected]