- Apptopia released a detailed mobile app performance analysis comparing Flutter Entertainment’s FanDuel app with DraftKings and Kalshi.

- The investor note reviews user engagement, churn, downloads, and app overlap across major US sportsbook operators.

- This is the first material third party dataset directly contrasting key operating metrics for NYSE:FLUT against close US peers.

Flutter Entertainment, through its FanDuel brand, is a major player in US online sports betting and gaming, competing directly with DraftKings and newer operators like Kalshi. As mobile usage sits at the center of how customers place bets and manage accounts, third party app data can help investors understand how often users are active, how sticky those users are, and how much they switch between competing apps.

The new Apptopia analysis gives investors a fresh reference point on how NYSE:FLUT is positioned against other US operators based on real world app behavior rather than just marketing spend or headline user counts. As regulatory frameworks, product features, and promotions continue to evolve, this type of independent app performance tracking may become a regular input for investors trying to gauge the relative strength of different sportsbook operators.

Stay updated on the most important news stories for Flutter Entertainment by adding it to your watchlist or portfolio. Alternatively, explore our Community to discover new perspectives on Flutter Entertainment.

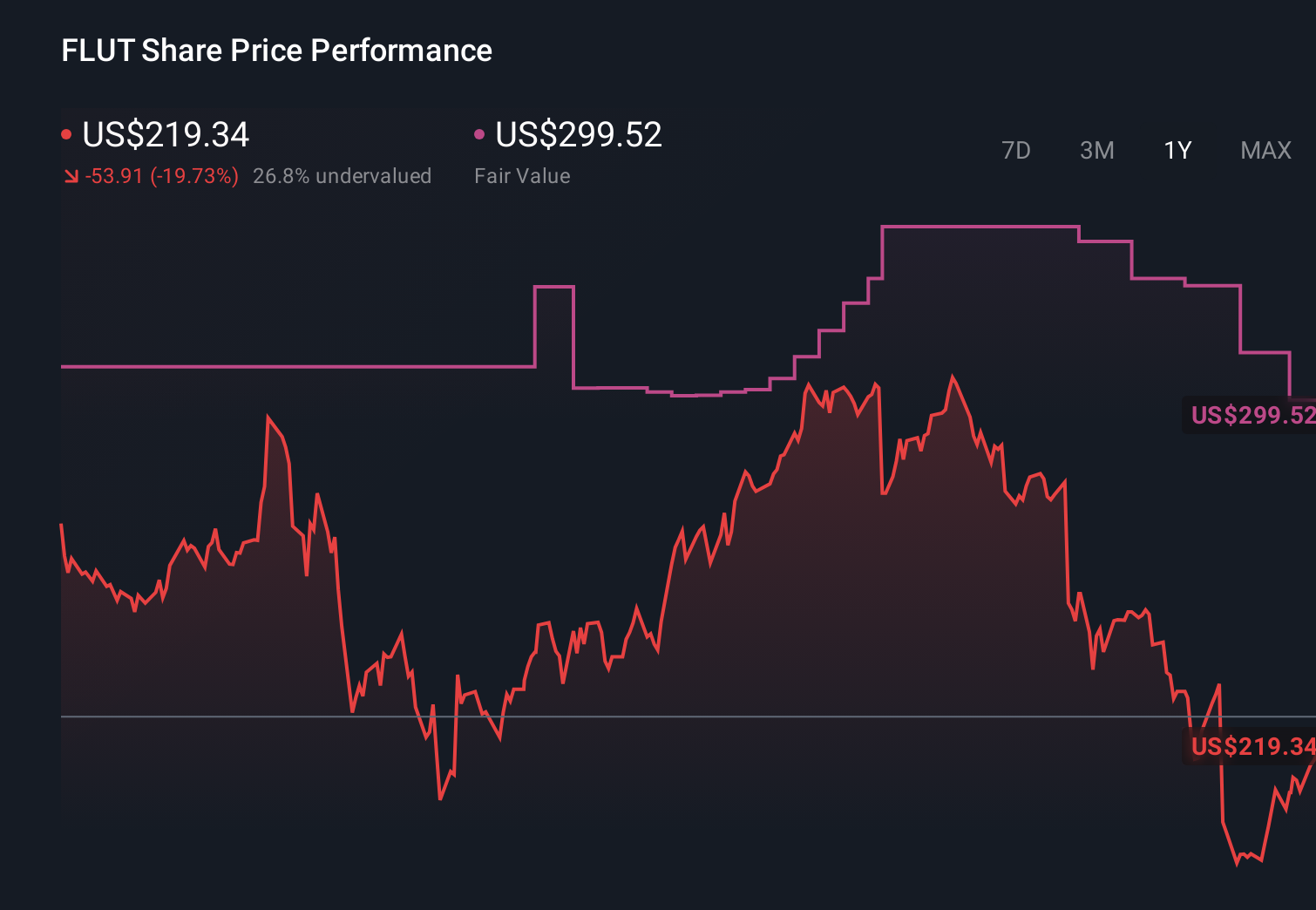

For investors, Apptopia’s app performance dataset arrives at a time when sentiment around Flutter is already fragile, with the share price down more than 50% from last summer’s highs and several brokers trimming price targets. Because it compares FanDuel directly with DraftKings and Kalshi on engagement, churn, downloads, and cross app usage, it gives the market a new, behavior based way to assess whether Flutter’s US position is holding up or slipping against close competitors such as DraftKings and smaller prediction market players. That can either reinforce existing concerns about competition and growth, or help investors differentiate between headline worries about slowing industry handles and how users are actually behaving inside the apps.

How This Fits Into The Flutter Entertainment Narrative

- The focus on time spent per user and app stickiness directly links to the narrative that product features such as live betting and personalized parlays can support deeper engagement and, over time, better economics for FanDuel.

- If Apptopia’s data were to show weaker engagement trends or higher churn for FanDuel versus DraftKings, it would sit alongside expectations for sustained earnings growth from US expansion in a less comfortable way.

- The cross app overlap with Kalshi and other prediction products adds a layer of competitive behavior that is not fully captured in the high level discussion of prediction market disruption in the existing narrative.

Knowing what a company is worth starts with understanding its story.

Check out one of the top narratives in the Simply Wall St Community for Flutter Entertainment to help decide what it is worth to you.

The Risks and Rewards Investors Should Consider

- ⚠️ A sharper slowdown in US online sports betting, highlighted by recent price target cuts from UBS and Bernstein, could weigh on sentiment if app metrics hint at softer engagement or market share pressure.

- ⚠️ Prediction market products from both Flutter and rivals such as DraftKings and Kalshi introduce regulatory and competitive uncertainties that may not translate cleanly into near term profitability.

- 🎁 Third party app data can help investors test whether the multi month selloff has moved ahead of underlying user behavior, especially if FanDuel’s engagement compares well with peers.

- 🎁 Independent tracking of churn and downloads offers an additional way to judge whether Flutter’s product investments are resonating with US customers as the market matures.

What To Watch Going Forward

From here, it may be useful to monitor how often datasets like Apptopia’s are referenced alongside earnings, particularly when analysts revisit their assumptions on US growth and customer retention. For Flutter, the key questions are whether FanDuel can sustain high quality engagement relative to DraftKings and whether prediction focused apps such as Kalshi remain a niche competitor or become more material. Revisions to broker targets and commentary around share volatility could increasingly draw on these app metrics, so updated releases during major sports seasons or regulatory milestones may carry extra weight for the stock’s narrative.

To stay informed on how the latest news affects the investment narrative for Flutter Entertainment, visit the

community page for Flutter Entertainment to keep up with the top community narratives.

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email [email protected]