Super Bowl product push puts Flutter Entertainment (FLUT) in focus

Flutter Entertainment (FLUT) is drawing attention as its FanDuel unit rolls out hundreds of Super Bowl LX betting markets and a new nationwide prediction product, with fourth quarter results approaching later in February.

See our latest analysis for Flutter Entertainment.

Despite the Super Bowl push and upcoming Q4 report, recent momentum has been weak, with a 30 day share price return showing a 29.15% decline and a 1 year total shareholder return reflecting a 43.20% loss, although the 3 year total shareholder return of 5.19% is still positive.

If this Super Bowl themed activity has you thinking about where else growth stories could emerge, it might be a good time to scan 22 top founder-led companies for fresh ideas.

Flutter’s shares have dropped sharply over the past year, yet the stock still carries a value score of 4 and trades at an apparent intrinsic discount. Is there a real opportunity here, or is the market already pricing in future growth?

Most Popular Narrative: 46.5% Undervalued

Flutter Entertainment’s most followed narrative pegs fair value at $285.33 per share, well above the last close at $152.53. This is putting a lot of attention on what is baked into those assumptions.

Analysts have trimmed their fair value estimate for Flutter Entertainment by roughly US$10 to US$285. This reflects slightly higher discount rates and lower target P/E multiples, even as they factor in modestly stronger revenue growth and profit margin assumptions supported by recent Street research updates and mixed rating changes.

Want to see what is driving that near term reset alongside a still confident long term earnings path, including higher margins and faster top line growth assumptions? The full narrative lays out how these moving parts connect to that fair value and the kind of profitability profile it is built on.

Result: Fair Value of $285.33 (UNDERVALUED)

Have a read of the narrative in full and understand what’s behind the forecasts.

However, you still need to weigh regulatory and tax pressure in key markets, as well as the company’s US$8.5b net debt load, which could reshape these bullish assumptions.

Find out about the key risks to this Flutter Entertainment narrative.

Another Angle On Flutter’s Value

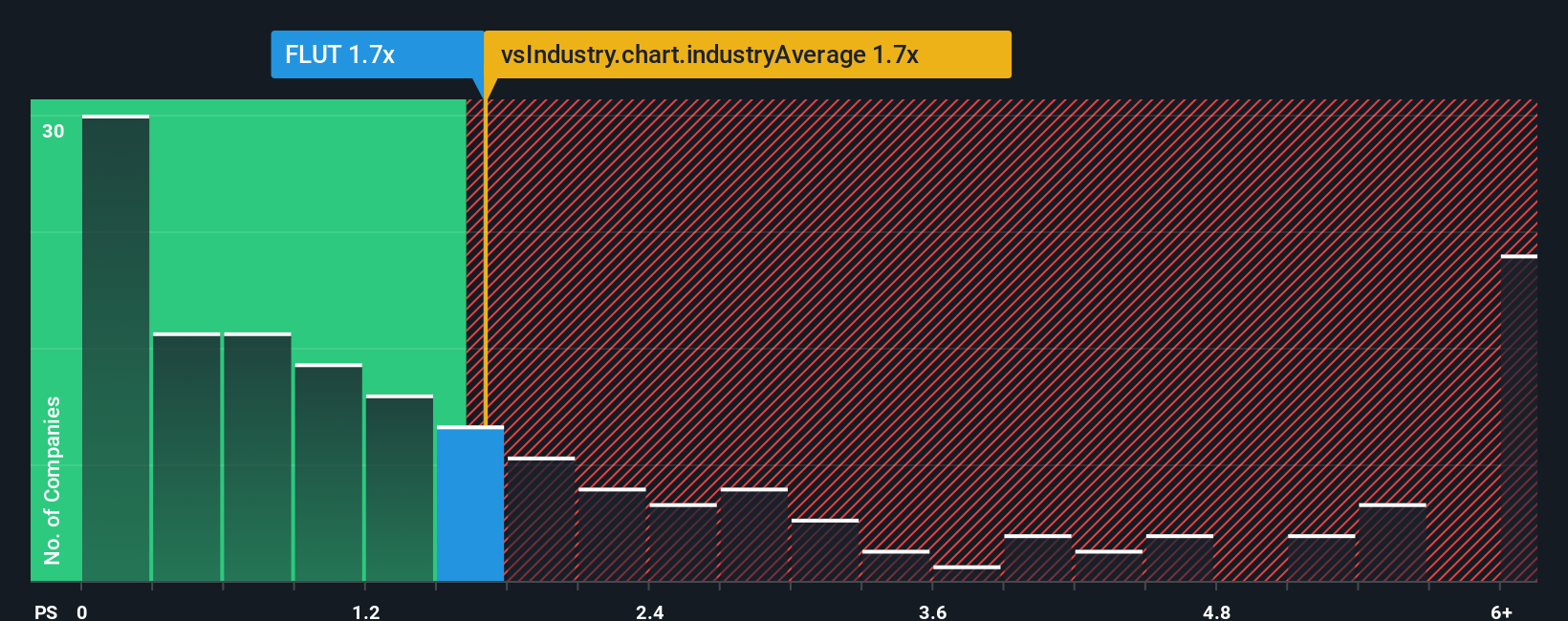

The first fair value view relies on long term cash flow and earnings assumptions. By contrast, Flutter’s 1.7x P/S looks roughly in line with the US Hospitality average of 1.7x, yet below a fair ratio of 3.1x, which hints at a possible discount. Is that a genuine opening or simply a reflection of the risks involved?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Flutter Entertainment Narrative

If you are not fully convinced by this view or simply prefer to test the numbers yourself, you can build a personalised Flutter thesis in just a few minutes and Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Flutter Entertainment.

Looking for more investment ideas?

If Flutter has you thinking about what else could belong on your watchlist, do not stop here. Broaden your view and stress test your portfolio ideas.

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email [email protected]