Pemex seeks to diversify crude sales in wake of US tariffs

State oil company Pemex is seeking to further diversify its crude sales in light of the United States’ decision to impose 25% tariffs on all imports from Mexico, according to the Reuters news agency.

Citing information from an unnamed senior Mexican government official, Reuters reported on Thursday that Pemex is in talks with potential buyers in Asia, including China, and Europe.

The report — published before United States President Donald Trump announced on Thursday morning an almost one-month pause on tariffs on imports from Mexico — comes a day after President Claudia Sheinbaum said that Mexico will seek other trade partners if U.S. tariffs on Mexican goods remain in place.

The United States imposed 25% tariffs on all imports from Mexico and most imports from Canada on Tuesday. The U.S. is taxing Canadian oil at 10%, but Mexican crude is (or was) subject to the full 25% levy.

Reuters reported that 57% of the 806,000 barrels per day (bpd) of crude Pemex exported last year went to the United States.

It noted that Pemex exports some crude to Europe and Asia, particularly India and South Korea, but highlighted that “the lion’s share” of the state oil company’s flagship heavy sour Maya oil goes to the United States.

The government official who spoke to Reuters on the condition of anonymity said “the good thing is that there’s appetite for Mexican crude in Europe, in India, in Asia.”

“There’s demand for heavy crude and Pemex crude,” the source said.

The official said that potential Chinese buyers were “very interested” in purchasing Mexican crude in initial talks with Pemex.

“Demand will decide how these flows are redirected,” the source said.

The official said that Pemex would not give a discount to United States clients in an attempt to retain them while its oil exports to the U.S. are taxed at 25%, as could once again be the case starting in early April. The source said that Pemex buyers in the U.S. haven’t discussed terminating their contracts.

Two other sources at Pemex’s trading arm PMI Comercio Internacional told Reuters that China, India, South Korea and even Japan would be suitable markets for Mexican crude in light of the United States tariffs on Mexican goods. Their assessment took into account higher shipping costs to get Mexican oil to Asia.

One of the PMI sources told Reuters that “only Asia” could take the volume of oil not sent to the United States. That assessment took into consideration the capacity of refineries to process the specific type of crude exported by Pemex.

The two PMI sources also said that Pemex doesn’t have any plans to discount crude to make exports more competitive.

Whether the United States’ tariffs on imports from Mexico will once again take effect in April is unclear. Trump announced Thursday morning that “Mexico will not be required to pay Tariffs on anything that falls under the USMCA Agreement” until April 2.

The announcement came after Trump spoke to President Claudia Sheinbaum.

Whether Pemex will still seek to sell more crude to buyers in Asia and Europe wasn’t immediately clear.

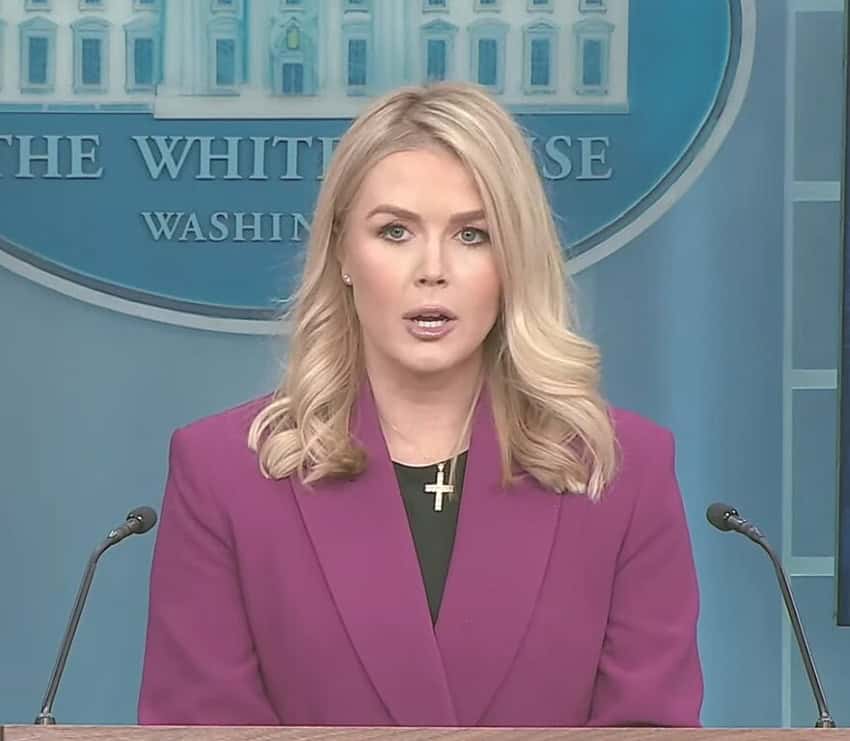

White House Press Secretary Karoline Leavitt said Wednesday that Trump had decided to grant a one-month tariff exemption to automakers importing vehicles from Mexico and Canada.

Mexico is aiming to become self-sufficient for fuel and consequently is keeping more crude in the country to refine at Pemex refineries. However, output from Mexico’s older oil fields, most of which are in the Gulf of Mexico, has declined to its lowest level in more than 40 years, Reuters said.

In January, “exports slumped 44% year-on-year to 532,404 bpd, the lowest level in decades,” the news agency reported.

Pemex is one of the world’s most indebted oil companies, with debt and liabilities in excess of US $100 billion.

With reports from Reuters

Source: Mexico News Daily