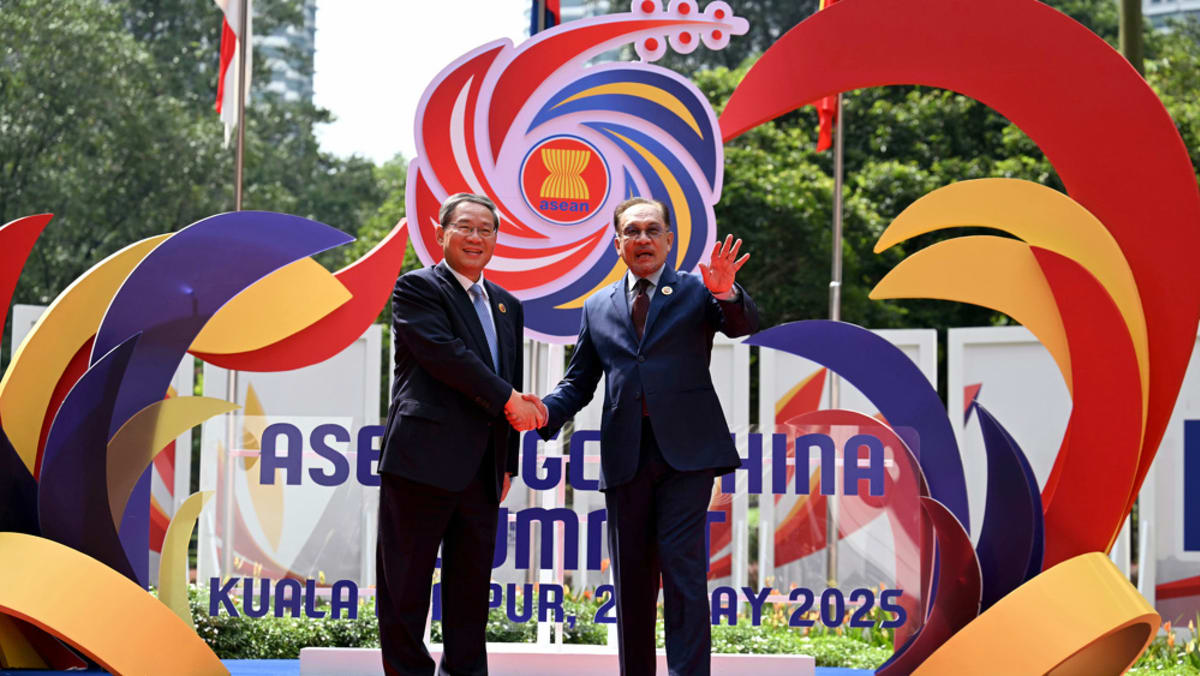

‘Big game-changer’: Can ASEAN’s next-gen trade pact with China deliver on its promise?

Kishore also warned of a long-term risk for Thailand.

The kingdom’s manufacturing prowess – spanning steel mills, cable factories and EV component plants, has made it a focal point for Chinese green-economy investments, even as the nation imposes anti-dumping duties on steel to protect local producers.

“The risk, which is actually playing out in Thailand (now), is Chinese investments come in … help develop the green economy, but knowledge transfers do not happen,” she said.

“So it ends up being dominated by Chinese manufacturers in these New Age industries but you don’t build domestic capabilities.”

Myers signalled the risks to ASEAN’s companies and industries “if Chinese firms come to dominate and crowd out smaller Southeast Asian businesses”.

“There are also worrying signs that the deal’s primary beneficiaries will be large Chinese firms that are already dominant in 3.0’s target sectors, like electric vehicles (BYD) and digital infrastructure (Huawei),” said Myers.

Smaller and less-developed economies like Cambodia, Laos and Myanmar, would not stand to gain as much, Lee, the senior analyst from EIU said.

“They are at very early stages in terms of development and do not necessarily have very sophisticated exports that can go to China.”

But on the other hand, technology transfer, technical cooperation and assistance could prove very beneficial for those countries, Lee added.

“We also know that the Philippines does not have the best relations with China, and in terms of the economy, (its goods and products) do not necessarily gravitate towards areas Chinese consumers are particularly interested in.”

“As it currently stands, the Philippines may not benefit a lot from ACFTA 3.0.”

Source: CNA