Malaysian construction giant IJM under probe over alleged US$617m money laundering; share prices slide

Earlier, the United Kingdom Serious Fraud Office reportedly launched an investigation into alleged money laundering and corruption involving multi-billion ringgit investment transactions and the two executives, according to local news agency Bernama.

The probe comes just days after IJM emerged as a takeover target for conglomerate Sunway Bhd, which proposed a share-and-cash acquisition valuing IJM at slightly over RM11 billion.

Sources cited by Bernama also said that MACC is looking into allegations of share price manipulation, which allegedly occurred when Sunway was in the process of acquiring IJM.

An MACC source said that the anti-graft agency has approached Sunway to assist in its investigation.

Sunway is controlled by its founder and chairman Jeffrey Cheah, 80, who holds a 0.5 per cent direct interest and a 60 per cent indirect stake in the group while IJM is owned largely by various institutional funds, with its biggest shareholder being the Malaysia Employees Provident Fund (EPF), which holds a 16.8 per cent stake.

Sunway’s proposed acquisition has drawn criticism, including from UMNO youth chief Akmal Saleh who questioned why IJM was being targeted despite being profitable and effectively managed.

In a TikTok video, he said that while the proposed takeover may seem like an ordinary transaction, it involves public funds, government-linked entities and Bumiputera economic interests.

Akmal highlighted that government-linked entities like EPF, Retirement Fund Inc (KWAP), Lembaga Tabung Haji and the Armed Forces Fund Board collectively hold nearly half of the shares in IJM, reported Free Malaysia Today.

“If a company is making losses or is poorly managed, we understand (the need for a takeover) … but in the previous year, IJM reported a profit (before tax) of nearly RM964.17 million,” he said.

Lembaga Tabung Haji is a government agency that facilitates the Muslim community’s savings for pilgrimage.

Sunway is largely controlled by Cheah, who is an ethnic Chinese. Akmal said that that selling IJM to Sunway could result in the loss of Bumiputera stakes in major companies in Malaysia.

He added that bumiputera stakes in major Malaysian corporations are “already limited” and the deal would reduce that interest if it goes through.

Echoing these concerns, the Malaysian Businessmen and Industrialists Association objected to the proposed acquisition, saying that the deal undermines national interests, undervalues IJM and threatens Bumiputera equity as well as public funds entrusted to government-linked investment institutions.

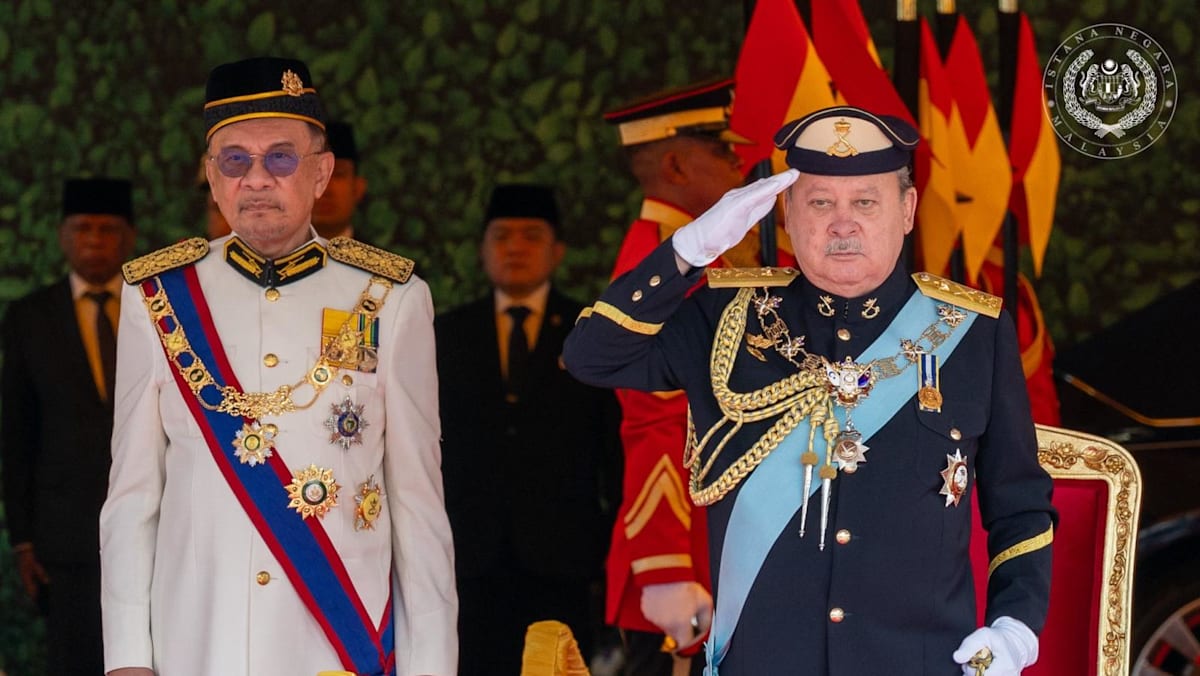

The association president Azamanizam Baharon urged Prime Minister Anwar Ibrahim to intervene in the deal to prevent a “major and historic policy mistake”.

“The deal involves the transfer of strategic national assets using high-risk financial instruments that can negatively impact millions of Malaysians,” he said in a statement over the weekend.

Source: CNA