SkyBridge bets on rising volatility, cautiously optimistic on bitcoin, Scaramucci says

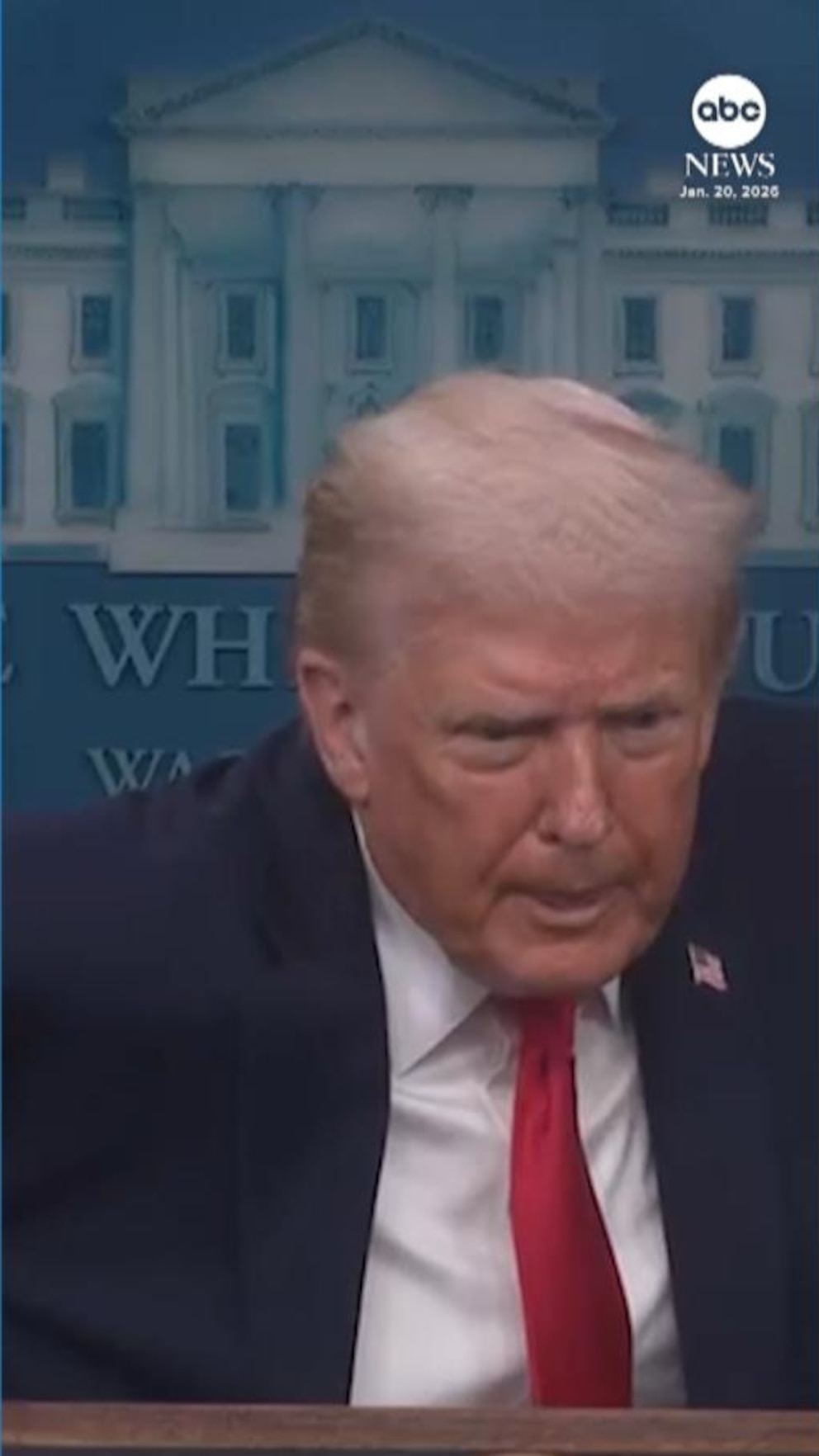

DAVOS, Switzerland, Jan 20 : Alternative asset manager SkyBridge Capital is tilting further towards macro strategies as policy uncertainty under U.S. President Donald Trump’s administration fuels market swings, founder Anthony Scaramucci said in Davos, Switzerland.

“Because of the volatility, the macro traders have done better,” Scaramucci told the Reuters Global Markets Forum on the sidelines of the World Economic Forum’s annual meeting.

Scaramucci, a staunch crypto advocate whose firm has invested heavily in digital assets, believes bitcoin’s long-term story is intact despite a sharp pullback from last year’s record highs.

“This is more of a timing issue than a direction issue. I don’t think the fundamental story for bitcoin has changed. If anything, you’ve seen a lot of consolidation,” he said.

His U.S.-based firm’s September 2025 filings showed its SkyBridge Opportunity Fund, focused on alternative investment strategies, shifting to a heavy macro weighting of 69 per cent, from its March 2025 weighting of 65 per cent in cryptocurrency and digital assets.

Bitcoin saw a tumultuous 2025, with the world’s largest cryptocurrency hitting an all-time high of over $126,000 in October, followed by a subsequent crash that led to more than $19 billion worth of liquidations across leveraged crypto market positions, the largest liquidation in crypto history.

“I would like to see bitcoin back to $125,000 to $150,000,” Scaramucci said. “But it’s bitcoin … (it) does whatever it wants.”

Bitcoin was hovering below $90,000 on Tuesday, about 28 per cent lower than its October 2025 record high.

Scaramucci, who in 2024 predicted that bitcoin would hit $170,000 by late 2025, said: “All of us in the bitcoin community got overly enthusiastic about the end of repressive regulation in digital assets … and none of that happened,” he said, referring to the stablecoin legislation, the Genius Act, and crypto market structure bill, the Clarity Act, under consideration by the U.S. Congress.

The stablecoin legislation was ratified in July last year. Meanwhile, the Clarity Act, which would define when crypto tokens are securities, commodities or fall into other categories, is under consideration in the U.S. Senate.

“I’m cautiously optimistic. I think we’ll have an OK year,” he said.

Source: CNA