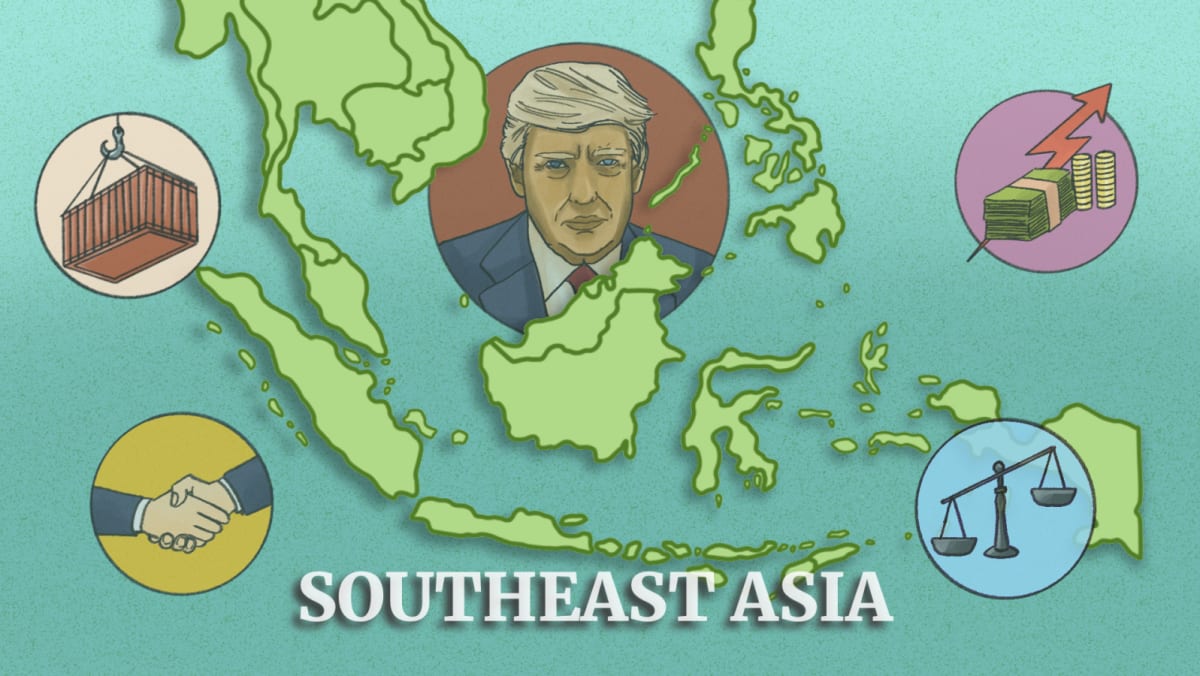

As Trump’s shadow looms, Southeast Asian economies face ‘hard challenges’ in 2025

Meanwhile, in Malaysia, Anwar has introduced a higher minimum wage and bumped salaries for the civil service – moves that are expected to increase private consumption and drive economic growth, said Malaysia-based economist Shankaran Nambiar.

Despite that, Nambiar pointed out that the higher minimum wage, alongside another policy to mandate retirement scheme contributions for foreign workers, are moves that will hit small- and medium-sized enterprises (SMEs) and potentially soften the economy.

Consistently described as the backbone of Malaysia’s economy, SMEs account for 48 per cent of employment and contribute 38 per cent of the country’s GDP, according to an October 2023 report by professional services firm EY.

Malaysia’s MSME sector grew 5 per cent and contributed RM613.1 billion to GDP in 2023, but remains highly vulnerable to external factors like policy decisions, technological advancements and geopolitical events.

After Anwar’s Budget 2025 speech, SMEs had warned that the higher minimum wage and mandatory Employee Provident Fund (EPF) contributions for foreign workers would further hit their bottom line at a time when their margins were already squeezed.

“The private sector, particularly the SME sector, may not be fond of a mandatory contribution to EPF for foreign workers. The higher costs might affect some of the less vibrant and smaller companies,” Nambiar said.

“With global growth marking a slightly lower level in 2025 … and China not being able to post the kind of exuberant figures they traditionally have, Malaysia is likely to fall closer to the lower end of the 4.5 per cent (in GDP growth).”

Malaysia’s finance ministry said in its macroeconomic outlook for 2025 that the global economy is projected to grow by 3.3 per cent next year, while China is forecasted to register 4.5 per cent growth mainly due to “sluggish productivity”.

TRUMP’S THREATS

China’s fragile economy is bracing for more US trade tariffs under a second Trump administration, which has threatened tariffs in excess of 60 per cent on imports of Chinese goods.

The US has also begun imposing tariffs on solar imports from Vietnam, Thailand, Cambodia and Malaysia, aimed at curbing Chinese companies that try to diversify their supply chains to avoid harsher tariffs.

Nambiar said the use of tariffs as a foreign policy measure could act as a dampener on Malaysia’s economy.

“The old story of expecting Chinese companies to move to Malaysia to avoid tariffs will not work, unless there’s going to be significant local content,” he said.

“Malaysia will have to be clearer with regard to its policies, particularly in relation to China. The Trump administration may not tolerate ambiguity too well.”

Asrul Hadi Abdullah Sani, a partner at strategic advisory firm ADA Southeast Asia, said the region’s trade surplus with the US could also make Malaysia’s exports, especially semiconductor industries, vulnerable to tariff risks.

“Therefore, it is key for Malaysia to continue to diversify its trade partnerships,” he said.

Asrul Hadi said Malaysia’s government should continue to streamline its agencies and departments, ease regulatory processes and improve transparency in decision-making.

“This approach will make Malaysia more attractive to foreign investments, particularly as the federal government aims to strengthen the country’s position in the global semiconductor supply chain,” he added.

Sunway University’s Yeah, however, highlighted that Trump’s pivot to tariffs and other trade weapons to protect US industries will have mixed effects on Malaysia, given the openness of the country’s economy and good relations with both America and China.

“The trade and investment diversion during Trump’s first term and (current President Joe) Biden administration’s trade disputes with China has benefited Malaysia as evidenced by the rise in FDI and trade volume,” he said.

“It will need to navigate the adverse trade impact and supply chain disruptions should the tariff hikes materialise. This will involve compliance with demand conditions, seeking alternative markets and providing assistance to affected firms to minimise enduring damage to the Malaysian economy.”

Malaysia’s finance ministry said in its macroeconomic outlook that while its trade volume with China is significantly higher than the US, trade with Washington is “crucial” for strategic economic sectors such as technology and healthcare.

“Any policy shift towards protectionism, such as higher tariffs and new non-tariff measures in these countries, could bring repercussions to Malaysia’s external sector,” it said.

Given Trump’s tariff escalation and the ongoing wars in the Middle East and between Russia and Ukraine, Yeah surmised that external conditions are expected to be volatile and unpredictable next year.

“To maintain growth, the government will need to be nimble and pragmatic in responding to potential large destabilising changes in the international trade and investment environment,” he said.

Source: CNA