Asian shares retreat after Trump’s victory as focus turns to the Fed

Shares retreated in Asia early Thursday (Nov 7) after US stocks stormed to records as investors wagered on what Donald Trump’s return to the White House will mean for the economy and the world.

Markets also were turning their attention to the Federal Reserve’s decision on interest rates, due later in the day.

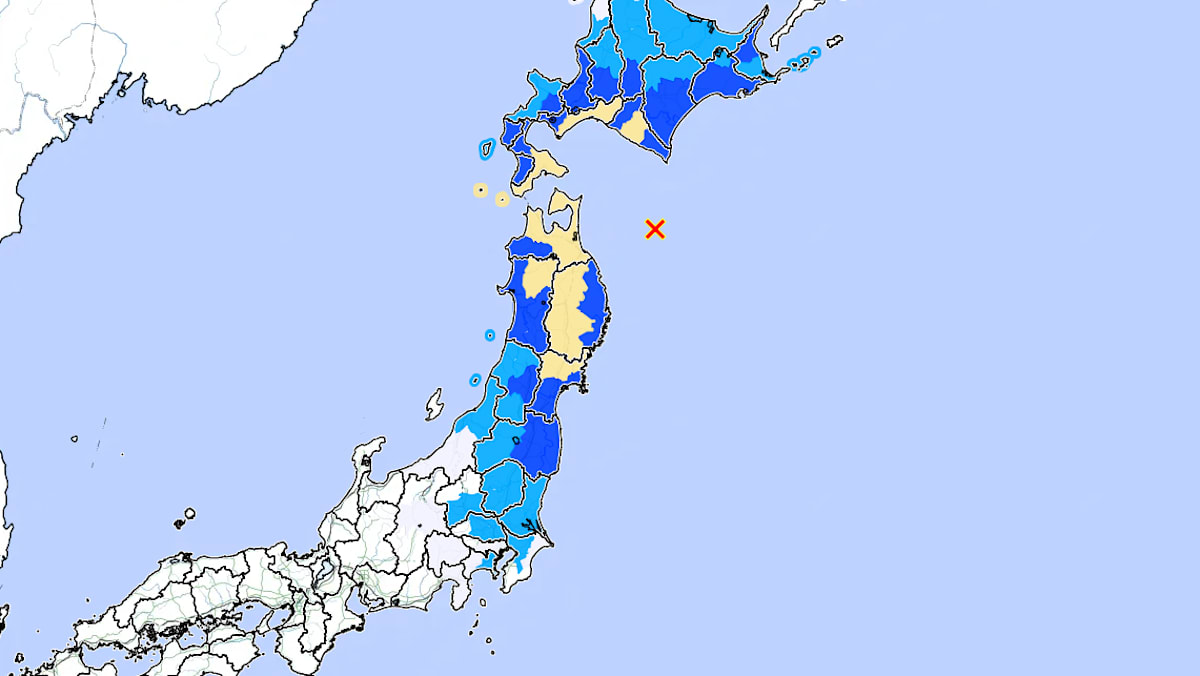

Japan’s Nikkei 225 shed early gains to fall 0.6 per cent to 39,246.86, while the Kospi in Seoul fell 0.4 per cent to 2,554.57.

Australia’s S&P/ASX 200 edged 0.1 per cent lower, to 8,191.00.

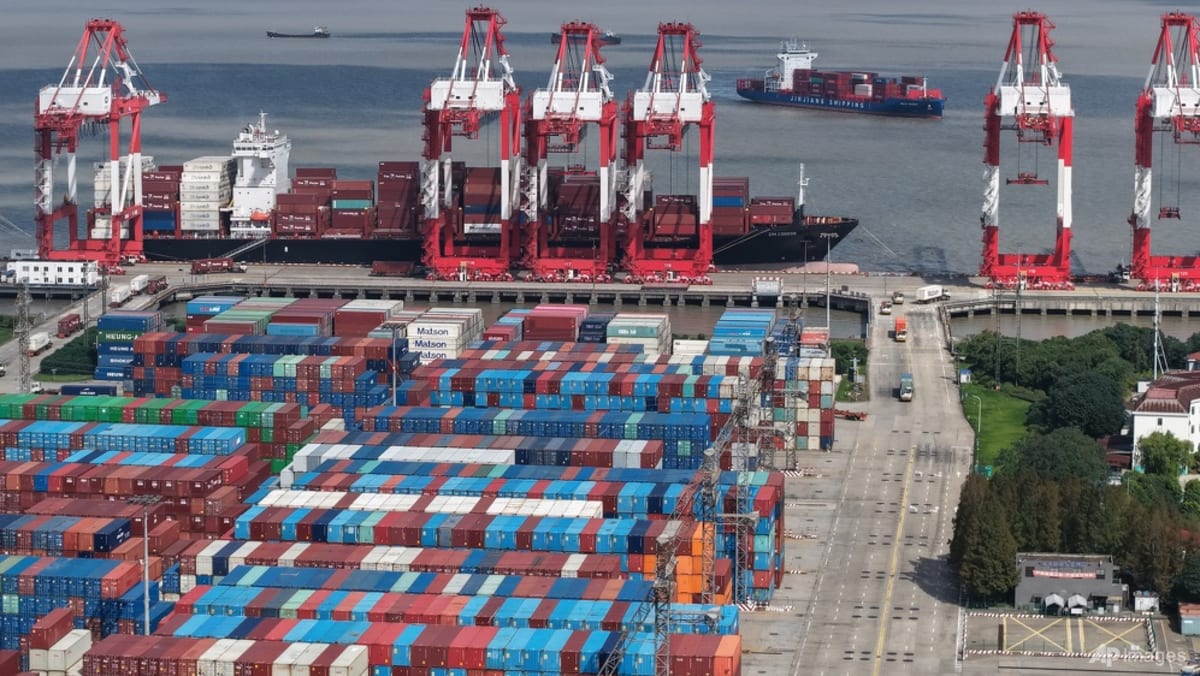

Chinese shares also declined. Hong Kong’s Hang Seng dropped 0.7 per cent to 20,386.36. The Shanghai Composite index also fell 0.7 per cent, to 3,359.99.

Trump has promised to slap blanket 60 per cent tariffs on all Chinese imports, raising them more if Beijing makes a move to invade the self-governing island of Taiwan.

Investors are adding to bets built earlier on what the higher tariffs, lower tax rates and lighter regulation that Trump favours will mean. Higher tariffs on imports from China would add to the burdens Beijing is facing as it struggles to revive slowing growth in the world’s second-largest economy.

Higher tariffs on imports from China, Mexico and other countries also would raise the risk of trade wars and other disruptions to the global economy.

On Wednesday, the US stock market, Elon Musk’s Tesla, banks and bitcoin all stormed higher, however, as investors made bets on what Donald Trump’s return to the White House will mean for the economy and the world.

Among the losers the market sees: The renewable-energy industry and potentially anyone worried about higher inflation.

The S&P 500 rallied 2.5 per cent to 5,929.04 for its best day in nearly two years. The Dow Jones Industrial Average surged 3.6 per cent to 43,729.93, while the Nasdaq composite jumped 3 per cent to 18,983.47. All three indexes topped records they had set in recent weeks.

Source: CNA