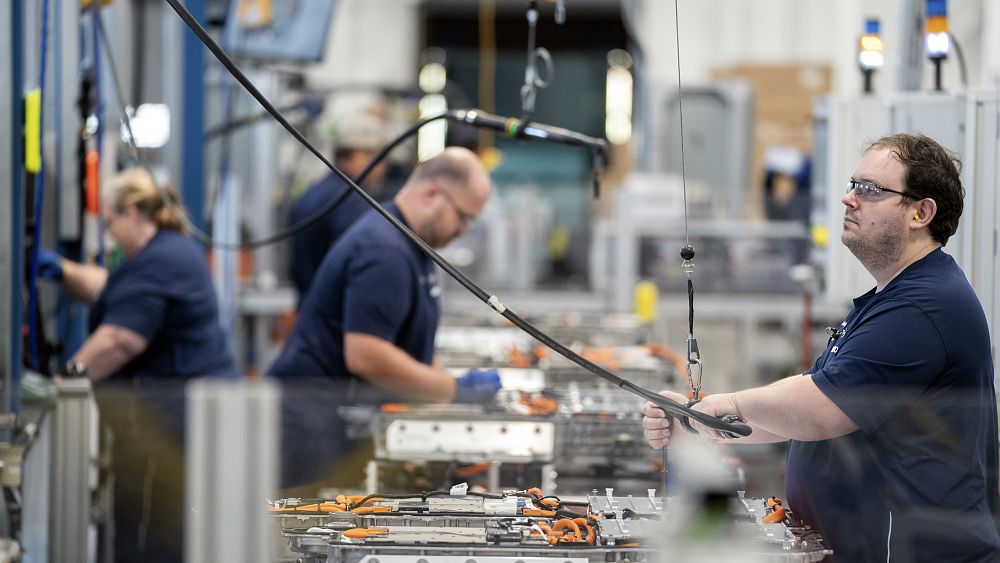

German downturn eases while French economy contracts sharply

Although both are in contraction territory, sentiment in the German economy is more optimistic.

The French economy recorded another steep contraction in business activity in November, staying on a downward trajectory since June.

Manufacturing remains the main drag on the wider economy, declining at the quickest rate for the past three years.

The picture in Germany is rosier with the economic slowdown showing signs of easing midway through the fourth quarter as business activity falls at its slowest pace in the past four months.

The economic outlook is based on S&P Global and Hamburg Commercial Bank (HCB)’s latest estimate of each country’s Purchasing Managers’ Index (PMI), which indicates what is really happening in the private sector economy by tracking variables such as sales, employment, inventories and prices.

In France, the global PMI is estimated to be at 44.5 this month, remaining well below the figure 50, which separates growth from contraction.

“The French economy is kind of in a dead-end. It looks as if geopolitical and economic uncertainty played a major role here,” Norman Liebke, economist at HCB, explained.

According to sub-sector data, strong pessimism reigns in the manufacturing sector in the euro area’s second-largest economy: Factory production’s PMI stands at 42.6, the lowest since May 2020.

Sentiment in the French services sector is more positive, meanwhile, but subdued. Services business activity PMI for November is forecast at 45.3, a three-month high. However, it is little changed from October’s 45.2.

German economy on the mend

In the euro area’s largest economy, the global PMI came in at 47.1 in November. Despite being the fifth consecutive month in the sub-50 contraction territory, it’s up from October’s 45.9 and the highest since July.

“Christmas is nearing and so is some hope for the German economy,” Cyrus de la Rubia, chief economist at HCB, said.

“The collective upswing fuels our growing confidence that a return to growth territory is a plausible prospect, potentially materialising by the first half of the upcoming year,” he added.

Expectations among manufacturers are improving but remain pessimistic. Manufacturing PMI is estimated to be at 42.3 in November, a six-month high that rose from 40.8 in October. However, it still shows an obvious contraction.

Activity this month was weighed down by a continued fall in demand for goods and services, with companies highlighting the impact of market uncertainty, tighter financial conditions and customers’ efforts to use their stock before buying.

Services is the economic sector closest to the 50 mark, with a PMI of 48.7.

Source: Euro News