Mexican peso starts the year strong with a favorable exchange rate

The Mexican peso appreciated to its strongest position against the US dollar in over four months on Friday after data showed that United States employers hired more workers than expected in December.

The peso was trading at 16.87 to the dollar at 3:00 p.m. Mexico City time, the currency’s strongest position since late August.

The peso closed just below 17 to the greenback last Friday, but was above that level on Tuesday, Wednesday and Thursday.

Gabriela Siller, director of economic analysis at the Mexican bank Banco Base, said that the appreciation of the peso on Friday was due to the better-than-expected employment data out of the United States.

The U.S. Labor Department’s Bureau of Labor Statistics reported that non-farm payroll employment increased by 216,000 in December and that the unemployment rate was unchanged at 3.7%.

Economists surveyed by Reuters had forecast payrolls rising by just 170,000 jobs.

Siller said that the U.S. employment data was “positive news for economic growth in Mexico, due to the close economic relationship between the two countries through exports.”

The stronger-than-expected job growth also makes it less likely that the United States Federal Reserve will cut interest rates in the very near term.

“Jobs growth remains as resilient as ever, validating growing skepticism that the economy will be ready for policy rate cuts as early as March,” said Seema Shah, chief global strategist at Principal Asset Management.

Nancy Vanden Houten, lead U.S. economist at Oxford Economics, predicted that the Fed will make an initial cut to its 5.25%-5.5% interest rate range in May.

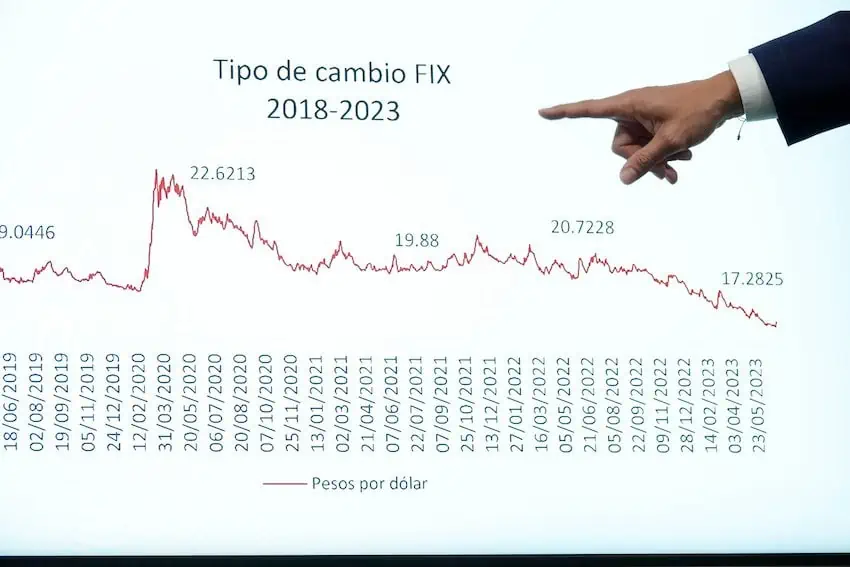

The wide difference between the Bank of Mexico’s record high benchmark interest of 11.25% and the Fed’s range is one factor that helped the peso strengthen in 2023 after it started last year at around 19.5 to the dollar.

Reuters reported Friday that the bank, abbreviated as Banxico, “drove inflows [of foreign capital] by leaving its key rate at a multi-year high of 11.25% for much of the year to lower inflation.”

Mexico’s central bank raised its key rate to 11.25% last March and has left it unchanged since then. The bank said last month that “the reference rate must be maintained at its current level for some time” in order to “achieve an orderly and sustained convergence of headline inflation to the 3% target.”

Many analysts believe that Banxico will make an initial cut to its key rate in the first half of 2024, but the bank’s board members don’t expect inflation to converge to the 3% target until the second quarter of 2025, according to the freshly-released minutes of their December monetary policy meeting.

Annual headline inflation ticked up to 4.46% in the first half of December, from 4.32% in November.

What’s in store for the peso in 2024?

The peso appreciated by about 15% against the US dollar in 2023, its best performance in over 30 years.

However, many analysts and financial organizations believe the currency will weaken this year.

All 33 banks, brokerages and research organizations consulted by Citibanamex for its most recent “expectations survey” predicted that the peso will depreciate in 2024. Their consensus forecast was that the USD:MXN exchange rate will be 18.65 at the end of 2024.

The median estimate of 25 currency strategists polled by Reuters in early January is that the peso will trade at 18 to the dollar at the end of 2024, a weakening of around 6% from its position on Friday afternoon.

“The expected drop is bigger than a consensus inflation forecast of 4.0%, meaning the currency will undergo some pressure from narrower [interest] rate differentials ahead,” Reuters reported.

Montserrat Aldave, principal economist in Finamex, told the news agency that “central banks will begin to ease in 2024 and we anticipate rate spreads between Mexico and the United States will decrease by 100-150 basis points.”

The current gap between the Bank of Mexico’s key rate and the Fed’s rate is 575-600 basis points.

“At 11.25%, Banxico’s rate continues to offer a big margin over the U.S. Federal Reserve’s range of 5.25%-5.50% for the cost of credit, which investors capitalize on in profitable so-called ‘carry trade’ bets,” Reuters reported.

A reduction in that margin could lead to a decrease in investment inflows to Mexico, and thus reduce demand for the peso and weaken the currency in 2024.

With reports from El Financiero and El País

Source: Mexico News Daily