Mexico’s automotive exports continue to skyrocket

The value of Mexico’s automotive sector exports increased by a double-digit percentage for the third consecutive year in the first 11 months of 2023 to reach a record high of almost US $173 billion.

Data published by the national statistics agency INEGI shows that auto exports were worth $172.68 billion between January and November, a 14.4% increase compared to the same period of 2022.

The strong growth in the value of auto exports came after even bigger increases in the first 11 months of the past two years: 18.6% in 2022 and 16% in 2021.

Auto exports slumped 19.3% between January and November 2020 as the coronavirus pandemic and associated restrictions took a heavy toll on the sector.

What percentage of Mexico’s total export revenue comes from auto exports?

INEGI data shows that Mexico’s exports were worth $543.76 billion in the first 11 months of the year. Auto sector exports, including vehicles and parts, contributed 31.8% of the total.

In other words, almost one in three export dollars earned in 2023 came from auto exports.

The total value of exported products made by Mexico’s diverse manufacturing sector was $484.85 billion between January and November, or 89.2% of total export revenue.

Auto sector exports accounted for 35.6% of the total manufacturing sector export revenue.

The auto sector’s contribution to Mexico’s GDP

According to the United States Department of Commerce (DOC), “the automotive sector is one of Mexico’s most significant industries, comprising 3.6 percent of the nation’s Gross Domestic Product (GDP), 18 percent of the manufacturing GDP, and employing over one million people nationwide.”

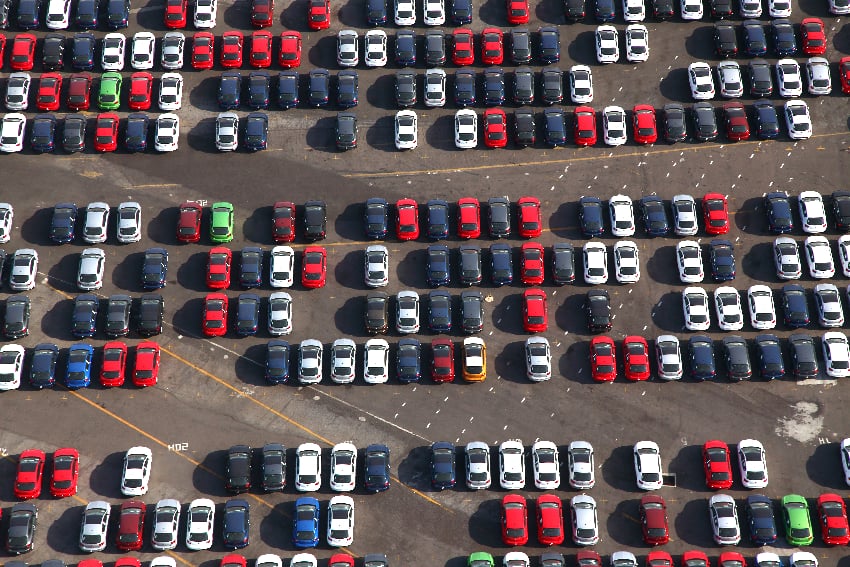

In a “country commercial guide” published last month, the DOC also said that Mexico is the world’s seventh-largest passenger vehicle manufacturer, making 3.5 million vehicles per year.

“Eighty-eight percent of vehicles produced in Mexico are exported, with 76 percent destined for the United States,” the department said.

“Established automakers in Mexico include Audi, BMW, Ford Motor Company, General Motors, Honda, Hyundai, Jac by Giant Motors, Kia, Mazda, Mercedes Benz, Nissan, Stellantis, Toyota, Volkswagen, and Tesla, which recently announced a new plant to be built in the state of Nuevo León as part of its electric vehicle production.”

DOC also said that Mexico is the fourth largest producer of auto parts in the world, “generating US $107 billion in annual revenues.”

Where are automakers located in Mexico?

Automotive manufacturers are “primarily concentrated in the northern region of Baja California, Sonora, Chihuahua, Coahuila, Nuevo León, and San Luis Potosí,” the DOC said.

“Original equipment manufacturer (OEM) plants are also based in Guanajuato, Aguascalientes, Jalisco, México state, Hidalgo, Morelos, and Puebla,” it added.

“In terms of supply chains, auto parts producers are located close to these plants, primarily in Coahuila, Chihuahua, Nuevo León, Guanajuato, Querétaro, Puebla, Tamaulipas, San Luis Potosi, and México state, although they are also found in other parts of the country.”

Is the future of Mexico’s auto sector electric?

The DOC noted that the market for electric vehicles, or EVs, is “evolving rapidly in Mexico as automakers have announced ambitious strategic goals to transition their offerings from gasoline to electric vehicles.”

“… While the market for EVs and hybrids totaled only 51,065 units in 2022, this represented a growth of 8.5 percent compared to 2021,” the department said.

BMW, Tesla and Volkswagen are among the automakers with plans to make EVs in Mexico.

Electric vehicles are “the future of the automotive industry,” President López Obrador said during a visit to BMW’s San Luis Potosí plant in February.

“The day will come when you won’t be able to sell vehicles that are not powered by renewable energy. … The future is in lithium, in batteries, in chips, in electric cars – that is the future,” he said.

With reports from El Economista

Source: Mexico News Daily