Tough negotiations and uncertainty ahead of OPEC+ meeting

MARKET SURPLUS

But since Wednesday, “some market chatter suggested the group may opt for another quota adjustment for October”, said Ole Hansen, an analyst at Saxo Bank.

Such a decision “would mean that (the group is) really serious about regaining market share”, said Leon, even if it means seeing prices fall below US$60 a barrel.

Moreover, “OPEC’s own analysis actually indicates that there is room for more oil in the market in the coming quarters”, said analyst Arne Lohmann Rasmussen of Global Risk Management.

“That fact alone may have encouraged the cartel to consider (reintroducing into the market) a second layer of voluntary production cuts,” he said, referring to reductions of 1.66 million bpd that were agreed in spring 2023.

So far, crude prices have held up better than most analysts had predicted since the production increases began, due in particular to looming geopolitical risks that have supported prices.

GEOPOLITICAL TURMOIL

Meanwhile, oil specialists are keeping a close eye on Moscow’s war in Ukraine as well as developments regarding US-Russia relations.

US President Donald Trump, whose efforts to mediate between Russia and Ukraine have failed to produce a breakthrough, has recently targeted Russian oil and those who buy it.

In August, he imposed higher tariffs on India as punishment for its purchases of Russian oil.

In a meeting with allies of Ukraine who gathered in Paris on Thursday, Trump told leaders via a video conference that he was frustrated with EU purchases of Russian oil, particularly by Hungary and Slovakia.

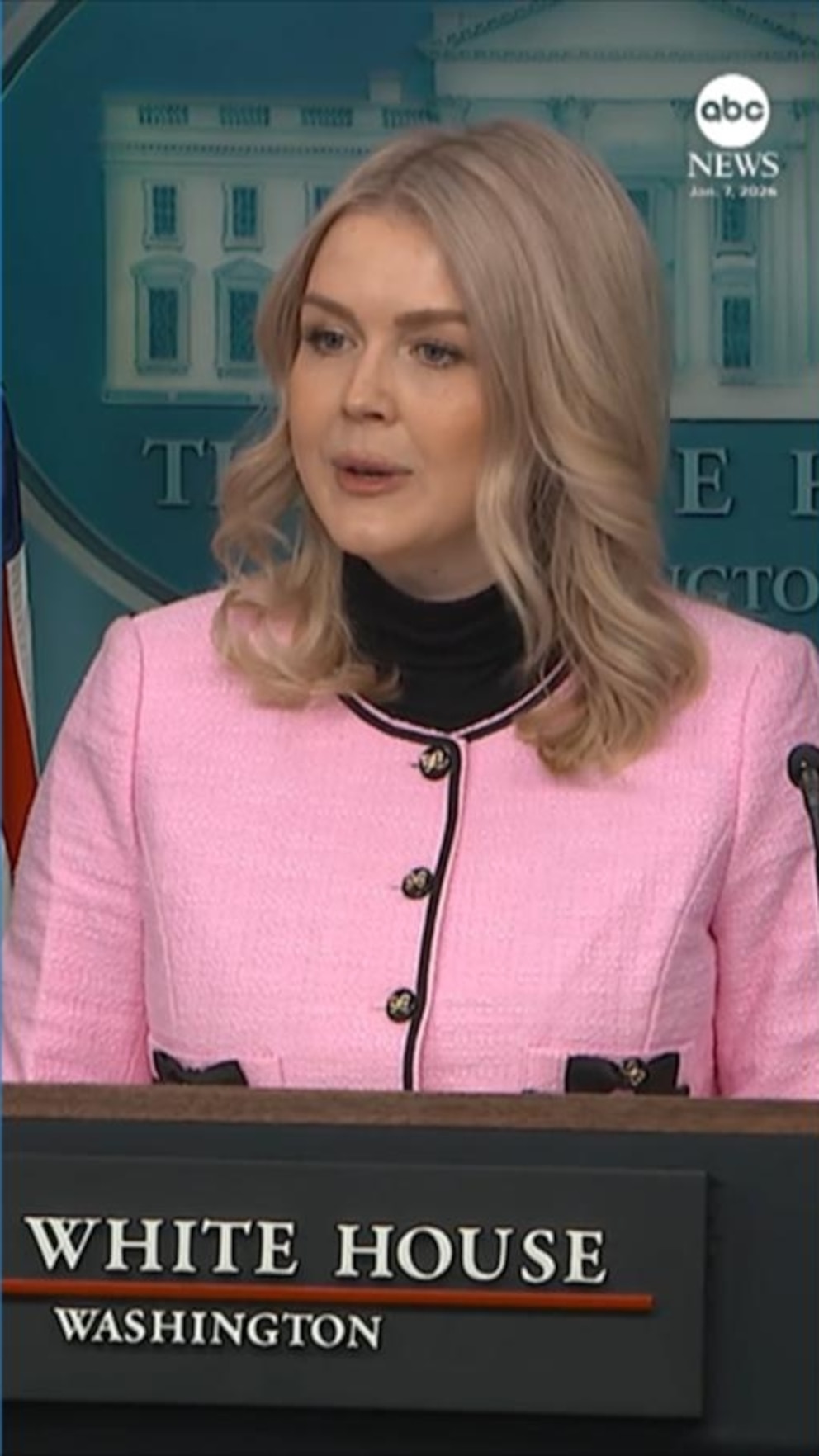

A senior White House official told AFP on condition of anonymity that Trump had insisted “Europe must stop purchasing Russian oil that is funding the war”.

He also called on European countries to put economic pressure on China for its support of Russia’s war effort, as Beijing is the largest importer of Russian oil.

Curbing Russian exports could free up market space for OPEC+ nations.

But Russia, the second-largest producer after Saudi Arabia, would probably find it difficult to take advantage of a further increase in quotas due to its interest in maintaining “high oil prices to finance its war in Ukraine”, Lohmann Rasmussen said.

Source: CNA