US tech giants reportedly want AI-related hardware made in Mexico

Major United States tech companies have asked their Taiwanese manufacturing partners to increase production of artificial intelligence-related hardware in Mexico, according to The Wall Street Journal.

Those firms — described as “some of the biggest U.S. companies in artificial intelligence” — are seeking to reduce their reliance on China, the Journal reported Sunday.

It noted that as the production of AI-related hardware increases, “U.S. companies are looking to avoid repeating the history of the smartphone after it took off some 15 years ago” as “much of the core manufacturing of smartphones and their parts” — including by Taiwanese companies — “ended up in China.”

The newspaper also reported that Taipei-based electronics contract manufacturer Foxconn is already making AI servers in Mexico for U.S. tech giants such as Amazon, Google, Microsoft and Nvidia. That information came from “people familiar with the operations,” but wasn’t confirmed by the U.S. companies, the Journal said.

Foxconn, Pegatron, Wistron, Quanta, Compal and Inventec — known in Taiwan as the “six brothers of electronics” — all have manufacturing facilities in northern Mexico.

Citing industry executives and analysts, the Journal said that Foxconn and other Taiwanese companies are “heeding the call” from U.S. companies to ramp up the production of AI-related hardware in Mexico.

It noted that Foxconn — which has plants in the northern cities of Ciudad Juárez and Tijuana — said in February that it spent around US $27 million to purchase land in Jalisco “in what people familiar with the plan described as a major expansion of the company’s AI server production.”

The Journal also noted that the company — the world’s largest contract electronics manufacturer — has said that it has invested $690 million in Mexico over the past four years.

In addition, Foxconn — also known as the Hon Hai Technology Group — and the government of Chihuahua announced last August that they had formed a “strategic partnership” aimed at “advancing talent training, fostering innovation technology, and promoting sustainable energy development in Mexico’s largest state.”

Foxconn, which makes electronic products for companies such as Apple, Sony and Nintendo, and some 300 other Taiwanese firms in Mexico, including a number of automotive suppliers, benefit from the USMCA free trade pact, which took effect in 2020, superseding NAFTA. As part of the growing nearshoring trend, companies from around the world are investing in Mexico to take advantage of USMCA, proximity to the U.S. and other factors.

The Journal noted that another Taiwanese company that is expanding in Mexico is Inventec, which makes AI servers and other high-tech products for major U.S. tech firms.

The newspaper highlighted that Inventec’s regional manager in Mexico, Arch Chen, told a conference in Taiwan in December that a leading American company involved in AI development chose to have its equipment produced in Mexico rather than the United States after inspecting facilities in Mexico and being impressed by their technology.

Meanwhile, major U.S. server manufacturers including Dell and Hewlett Packard Enterprise have asked their suppliers to shift some server and cloud computing production to Southeast Asia and Mexico, “reducing reliance on China,” the Journal said, citing “people familiar with the matter.”

The newspaper noted that it is becoming more difficult to manufacture high-tech equipment in China because the United States doesn’t allow the export to China of advanced chips for AI applications such as those designed by California-based Nvidia.

Taiwanese companies will contribute to major changes in Mexico’s industrial structure, says business leader

Francisco Cervantes, president of the influential Business Coordinating Council (CCE), said last year that the growing presence of Taiwanese firms in Mexico is part of a process that will “dramatically modify the industrial structure of Mexico in the next 10 years.”

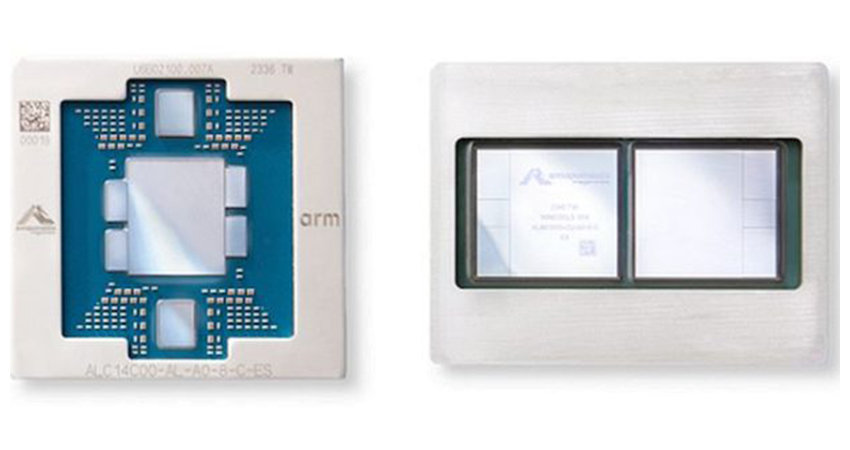

An increase in the production of AI-related hardware will inevitably lead to the creation of more advanced manufacturing jobs in Mexico and could help spur innovation in other manufacturing sectors. The hardware used in AI applications, the Journal noted, “consists of powerful computers called servers, storage systems, cooling units, connectors and other equipment.”

“… They are designed to tackle the complex calculations needed in AI programs and often incorporate cutting-edge processing units,” or AI chips, the newspaper said.

Cervantes was part of a group of Mexican officials and businesspeople who met last June with a delegation of representatives from 20 Taiwanese semiconductor manufacturers who traveled to Mexico to evaluate investment potential. Representatives from Foxconn and Inventec were part of the Taiwanese delegation that met with Economy Minister Raquel Buenrostro, billionaire businessman Carlos Slim, the CCE chief and others.

Both U.S. companies that work with Taiwanese firms and the U.S. government are actively seeking to reduce reliance on China and Asia more broadly for the supply of high-tech products such as semiconductors, commonly known as chips.

Just last week, the U.S. Department of State announced that it would partner with the Mexican government in a new semiconductor initiative whose ultimate aim is to strengthen and grow the Mexican semiconductor industry.

North American countries are hoping to “replace products imported from Asia as much as possible,” according to James Huang, chairman of the Taiwan External Trade Development Council.

“Based on this consensus, Mexico is poised to become the most important manufacturing base for the USMCA,” he said.

Indeed, Mexico is already attracting significant foreign direct investment as companies — especially manufacturers — seek to reduce their dependence on China and position themselves on the doorstep of the world’s largest economy while taking advantage of things such as affordable labor costs.

Mexico is an attractive investment option, but not one without problems

The Journal’s report acknowledged that foreign companies using Mexico as a production hub face a range of risks. They include crime, insufficient water and electricity supply, and “intense wage competition for workers skilled at assembling high-tech goods,” the newspaper said.

Mexico-based managers of Taiwanese companies who spoke with the Journal said they use private security services to stop crime groups from targeting their plants to steal chips and valuable equipment. They also said that Mexican workers are, in general, less willing than Chinese workers to put in extra hours.

Water supply is a concern in much of Mexico, leading President Andres Manuel López Obrador and other officials to encourage foreign companies to invest in the south and southeast of the country, where water is more abundant.

To spur such investment, the government has developed the Interoceanic Corridor of the Isthmus of Tehuantepec between the Pacific coast port of Salina Cruz, Oaxaca, and the Gulf coast port of Coatzacoalcos, Veracruz. Mexican officials last year encouraged Taiwanese firms to consider investing in the trade corridor, which includes a modernized coast-to-coast railroad and will also have a chain of industrial parks.

As for electricity supply, the director of the Federal Electricity Commission said in January that the state-owned utility is ready to provide the power required to meet nearshoring-related demand.

The government has invested significant amounts of money in both water and electricity infrastructure, but supply of the former, in particular, remains a major concern as much of the country continues to suffer from drought.

During the visit of the Taiwanese delegation last year, Economy Minister Buenrostro asserted that “Mexico is the country in the Americas that has invested the most in infrastructure projects in the last five years: airports, trains, highways, and more.”

The government has not, however, managed to significantly improve security.

Violence — mainly generated by organized crime groups — remains a major problem in parts of Mexico, including in states that are popular with foreign manufacturers such as Guanajuato and Baja California.

Homicides have trended down during López Obrador’s presidency, but the numbers remain high at around 30,000 per year, making the reduction of violence a major challenge for Mexico’s next president, who will take office on Oct. 1.

With reports from The Wall Street Journal

Source: Mexico News Daily